Home / Case studies / SimCorp creates innovative and user-centric software with the InvestApp

Case studies

SimCorp creates innovative and user-centric software with the launch of InvestApp

InvestApp is one of SimCorp’s freshest cloud solutions – an excellent tool for meticulous financial analysis.

SimCorp offers efficient, flexible front-to-back solutions, providing clients with either a SaaS (Software as a Service) platform or on-premises solutions. They encompass 6 global delivery centers and 30 international offices.

In November 2023, SimCorp announced a merger with Axioma. By integrating Axioma’s best-in-class asset class coverage, premier risk management, and portfolio construction and optimization tools natively within SimCorp, their customers can leverage an industry-leading investment and risk management technology platform.

SimCorp was founded in 1971 and is today a subsidiary of Deutsche Börse Group.

The challenge

As part of this strategy, SimCorp, in collaboration with cVation (part of Skaylink), chose to develop a proof of concept (PoC) project with modern “off-the-shelf” web technologies, such as Angular, AG Grid, and Apache ECharts etc.

The successful PoC laid the foundation of the development of InvestApp, which is part of SimCorp’s Investment Analytics Platform whose main purpose e.g. is complex financial calculation of returns and attribution based on direct interaction with the user and how various key figures are found in an intuitive and easy way.

As partners to SimCorp our overarching role was to help leverage the opportunities presented by modern application and cloud development.

The solution

The InvestApp product itself consists of a modern UI application developed in the Angular web framework, which demonstrates the potential of the Investment Analytics APIs. In addition to the UI and frontend project, cVation has been responsible for delivering the backend for the persistence of user configurations, which is based on the latest .NET and NoSQL technology.

As part of the solution, the infrastructure was also built. The delivery consisted of infrastructure-as-code using Azure cloud PaaS services, Bicep and CI/CD in YAML.

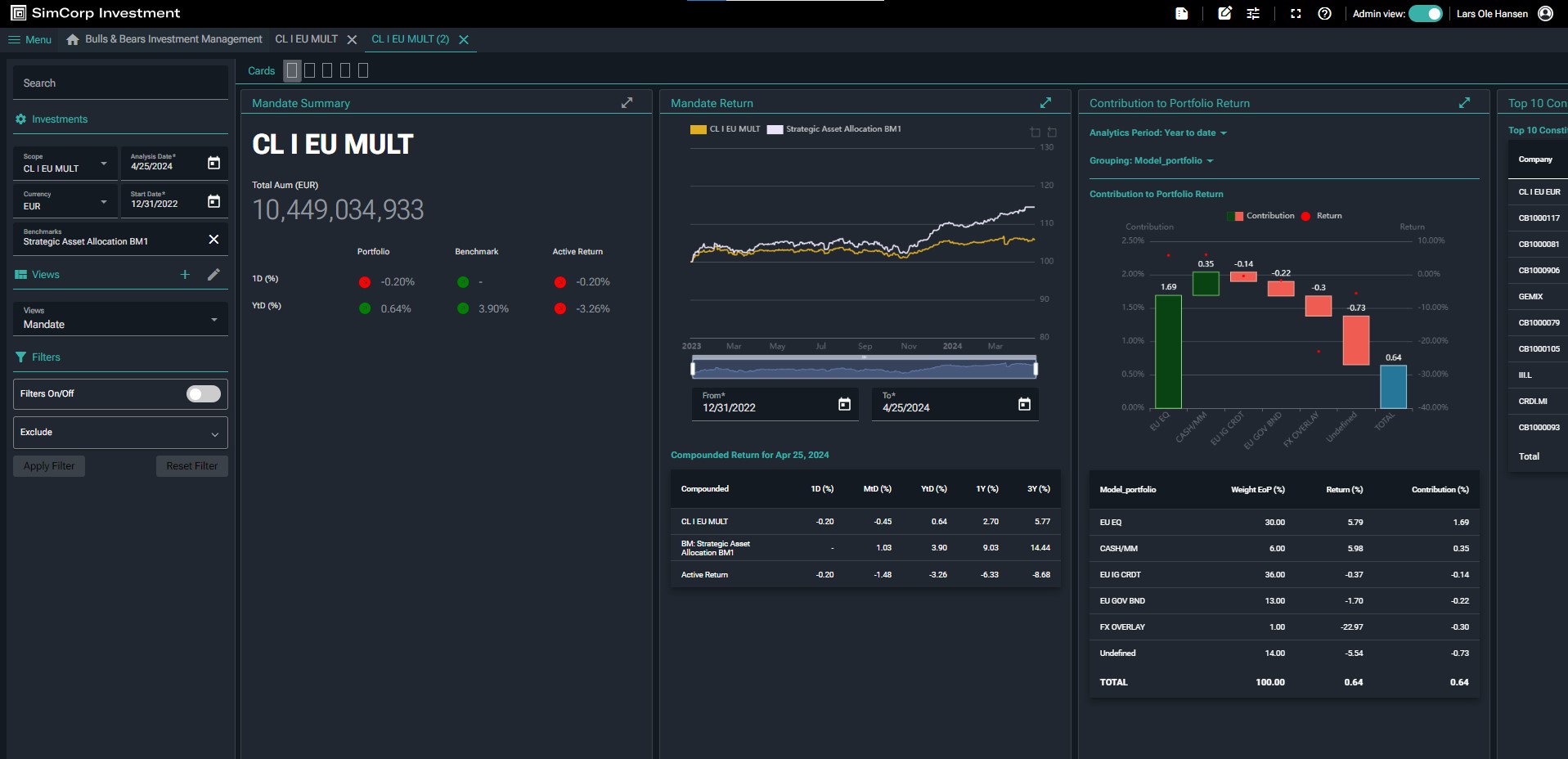

The app’s user interface is elegant and minimalistic in its expression, and the very focal point of this SaaS solution are the analytical results.

The basic development method used in the project is full CI/CD, with which every single change and “commit” to the main system is sent directly into production. This is why strict quality assurance is required, so that no errors are sent out and through to the actual application. Therefore, as part of the guardrail and methodology framework, changes undergo automatic testing and require approval from POs before being released for production.

As with all applications, security is incredibly important and absolutely central. Therefore, OpenID Connect was implemented to support a limited multi-tenant setup. This was also implemented by cVation in accordance to the requirements of SimCorp’s enterprise architects.

Users log in directly on the user interface and immediately gain access to a wide range of live financial data thanks to SimCorp’s backend APIs. The user interface is built with Angular Material UI components to give it a user-friendly and modern look.

The interface primarily consists of several graphic “maps” (graphs, tables, diagrams), as part of a dashboard. Each map is specifically designed to display information related to the respective area. The presentation of data and parameters (e.g. currency, calendar, benchmarks, etc.) is dynamic and user-adapted and the navigation is intuitive. The data is also flexible by e.g. interactive tables and graphs. Flexibility is also incorporated into the workflow as the list is contracted in the top screen and lets users jump easily between cases and portfolios.

Technologies used:

InvestApp is developed with following Microsoft technologies:

Frontend

- Angular

- AG-Grid

- E-Charts

Backend

- .NET

- NoSQL

- OpenID Connect

Infrastructure / CI/CD

- Azure Cloud PaaS Services

- Azure DevOps & Pipelines

- Bicep

“Really great interface, we find there is great potential in this solution.”

Pernille Olling, Senior Vice President, Performance & Reporting, Nykredit Wealth Management

The process

The cooperation across continents and countries has been great throughout the process. The team met up regularly at SimCorp headquarters, but as the team at times consisted of many remote employees, the meetings have primarily been online. The project was kept very agile, also the decisions and changes throughout the project were all handled by the established agile methods.

“When we started this project the development of web applications was new to SimCorp. We have really deep financial knowledge and backend development, but through this project cVation (part of Skaylink) has helped us work based on well-established best practices. This is why from the start, we have been able to create the best user experience and the best outcome for our customers”, says Lars Ole Hansen, Director, Principal Product Manager at SimCorp, Investments.

“InvestApp has been incredibly well received by SimCorp’s clients because it represents a completely new era, compared to the platform our previous desktop applications have been built on”, he continues. “The modern user experience and interaction with the underlying ground-breaking calculation engine, facilitates opening the doors to a much wider group of end users, including the discerning portfolio managers who depend on high flexibility and fast response time when making crucial investment decisions”. To the question on how the collaboration with the cloud experts was, he says:

“From day one cVation stepped in with strong thought leadership within the development of cloud applications. With their deep experience on the financial industry where security, compliance and solid deployment mechanisms are paramount, they quickly gained respect by their skills. During the project they were able to transfer their methods to our new team, who was to subsequently take over the responsibility.”

Lars Ole Hansen, Director, Principal Product Manager SimCorp, Investments

The result

InvestApp is already in production for the first customer, with the next just around the corner. Integrated Al functionality is also being added in the next version of the solution, which provides even more options in the future.

“The intuitive, flexible and fast access to performance analytics is a game changer in how performance analysts and portfolio managers gain insight to investment performance in the SimCorp universe.”

Ole Sørensen, Head of Business Development, Nordea Asset Management

With the change from a classic batch-oriented process, to the calculation and presentation of complex key return figures in a cloud-based on-demand calculation, SimCorp has managed to reduce calculations which used to take hours, to now deliver results directly to the end user in seconds.

It’s another important upgrade that the investment analysts now find their answers directly in InvestApp, instead of having to rely on reports from an operational team.

“When we talk about ‘cost of operations’ , this change means that we no longer keep a whole lot of data on Oracle, which is used for intermediate calculations and the case that someone might need it due to the calculation time. This resulted in double-digit terabyte volumes saved on the most expensive type of storage in the cloud. Now customers decide for themselves what they want to store and typically have much cheaper solutions such as Snowflake. The total cost saving on this would be measured in millions,” concludes Lars Ole Hansen with a smile.

SimCorp demonstrates their exceptional modern approach to software development with the delivery of products such as InvestApp. They have rolled out a future-proof app and thus established that modern technology which can be further developed at lightning speed is a priority and by this they put their clients’ user experience right at the center.

With uniquely adapted frames, the app gives users a great overview of exactly the data they need. In the end, this helps SimCorp do what they do best – providing razor-sharp analysis of financial data.

About the future, Lars Ole says:

“The release of InvestApp has strengthened SimCorp’s position in terms of executing on our Next Generation UX strategy. We use it to support the narrative that users will soon have a completely new experience when using the SimCorp ONE platform, not just in the Performance Attribution area. By this we now begin to reap the benefits of the cloud transformation in which we invested during many years. With the first modern web application, the value of it suddenly becomes very visible to the users.”

At SimCorp, they have already started creating similar solutions within Order Management, Risk Measurement and Portfolio Aanalysis/Optimization.

Read more about SimCorp.